So, the statement of cash flows is a good place to get information about that. Well, we need cash to do those transactions. It determines the company's ability to pay right when we have to pay interest or pay dividends. It helps us evaluate management, right? Because we can evaluate how management uh uses cash flows, the cash that it brings into the business and how it uses it in the business. How how's the company doing now? Well, that gives us the predictive value of what it's going to be doing in the future. It gives predictive value of future cash flows based on the past cash flows. So a lot of investors focused on cash flows and the statement of cash flows is a great place for that information. From a financial perspective from finance perspective, they are definitely focused on cash flows. A lot of investors are interested in the cash flows of the company. Okay, so why do we use the statement of cash flows? Well, first, it has predictive values. A lot of things happen in the cash account and we want to summarize them here with the cash flow statement. What got us from the beginning cash to the ending cash. Right? So the statement of cash flows focuses on these additions and subtractions. The statement of cash flows, it helps us get from our beginning cash balance to our ending cash balance right? We start we begin with some cash balance and then we're gonna have all sorts of additions to cash and subtractions to cash throughout the period that gets us to the ending cash balance. Right? And that's where we deal with dividends here. Remember we have our four main financial statements, we've dealt a lot with the balance sheet and the income statement, the statement of retained earnings or the statement of stockholders equity tells us the changes in stockholders equity or retained earnings. This is one of the tougher units in the course. Increases and decreases in current liabilities.Alright now we're going to discuss the statement of cash flows.Increases and decreases in noncash current assets.Noncash operating revenues and expenses.Identify and explain the adjustment from net income to obtain cash flows from operating activities using the indirect method for each of the following items:.What types of analyses are often made from the statement's information?Ĭommon analyses made from information in the statement of cash flows include assessing a company's:.List the beginning and ending cash balances to prove this.Īlso, identify and list noncash financing and investing activities in aseparate schedule or note. Computenet cash flows from financing activities.Prove that the net cash flow from the three categories combined equals the net change in cash.Computenet cash flows from investing activities.Compute net cash flow from operating activities using the direct or indirect method.This is the target number or the number the statement will explain and prove. Compute the net increase or decrease in cash using comparative balance sheet data.The steps to preparing the statement of cash flows are: What steps are followed to prepare the statement?.The indirect method is more widely used.The direct method is recommended by the FASB.The direct method requires an extra section reconciling net income to cash flows from operating activities.

#STATEMENT OF CASH FLOWS SAMPLE PROBLEMS SERIES#

The indirect methodstarts with net income and applies a series of adjustments to reconcile this accrual basis number to a cash basis number. The direct method determines all operating cash inflows and outflows, and then subtracts total operating outflows from inflows.

.png)

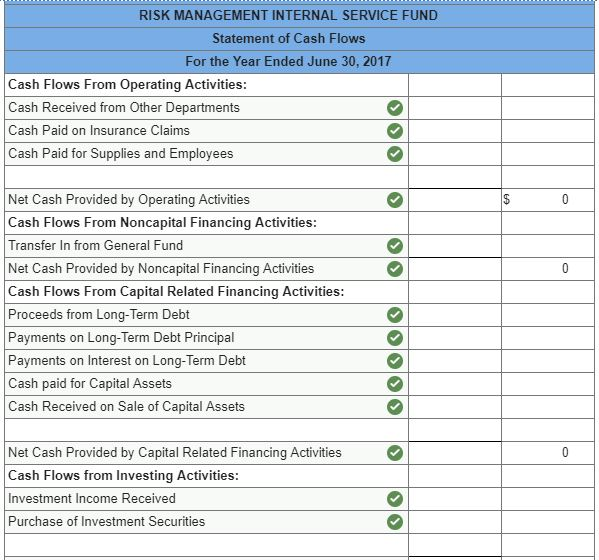

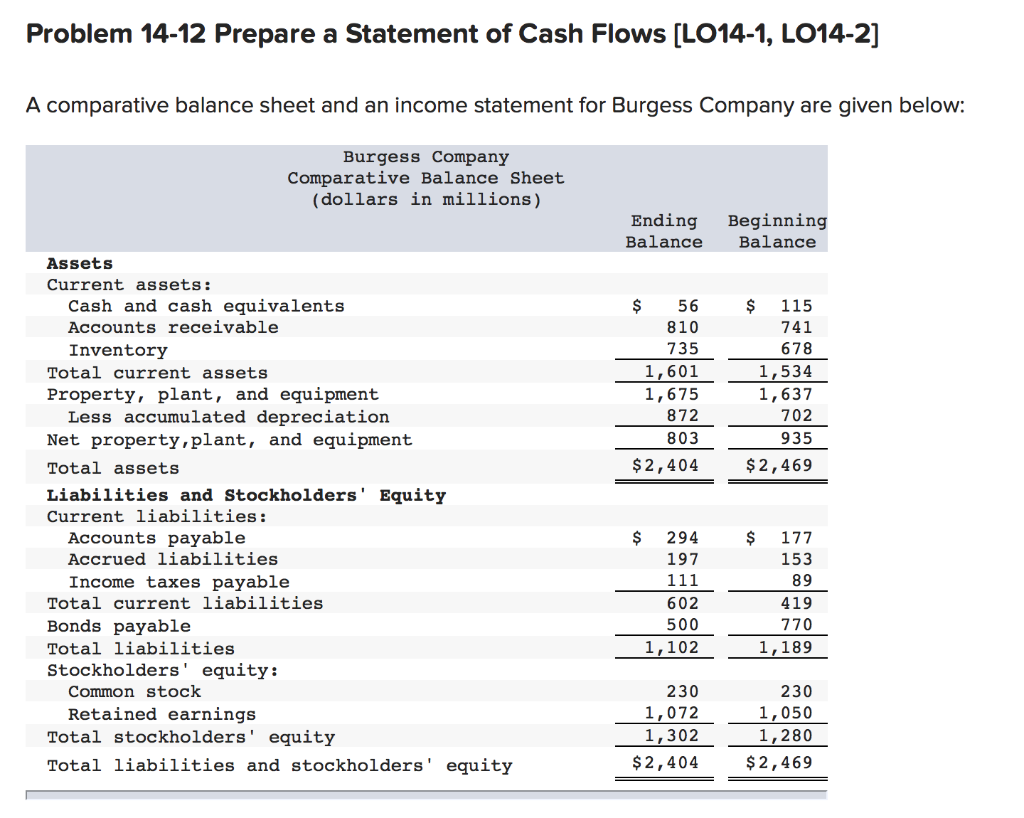

Listed below are a series of questions about the SCF. The purpose of this is to help solidify your understanding of the Statement of Cash Flows (SCF). This problem is different from that which you have seen on prior practice exams. ACCT 201 Principles of Financial Accounting

0 kommentar(er)

0 kommentar(er)